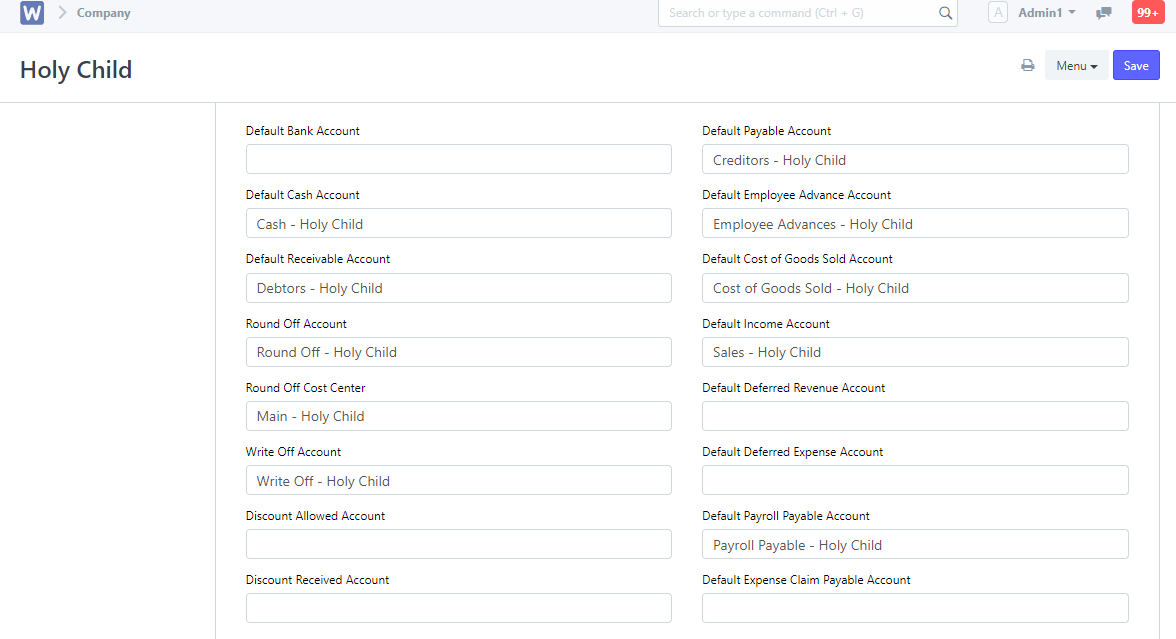

1.Company Account Defaults

Some of the following accounts will be set by default when you create a new company, others can be created. The accounts can be seen in the Chart of Accounts. These values can be changed later on if needed.

- Default Bank Account

- Default Cash Account

- Default Receivable Account

- Round Off Account

- Round Off Cost Center

- Write Off Account

- Discount Allowed Account

- Discount Received Account

- Exchange Gain / Loss Account

- Unrealized Exchange Gain/Loss Account

- Default Payable Account

- Default Employee Advance Account

- Default Cost of Goods Sold Account

- Default Income Account

- Default Deferred Revenue Account

- Default Deferred Expense Account

- Default Payroll Payable Account

- Default Expense Claim Payable Account

- Default Cost Center

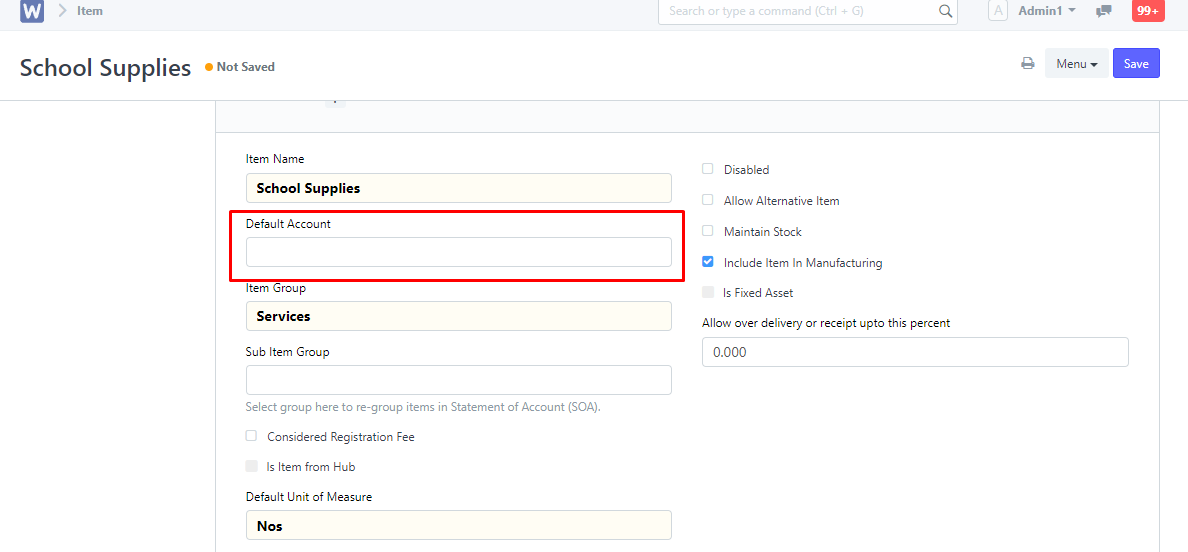

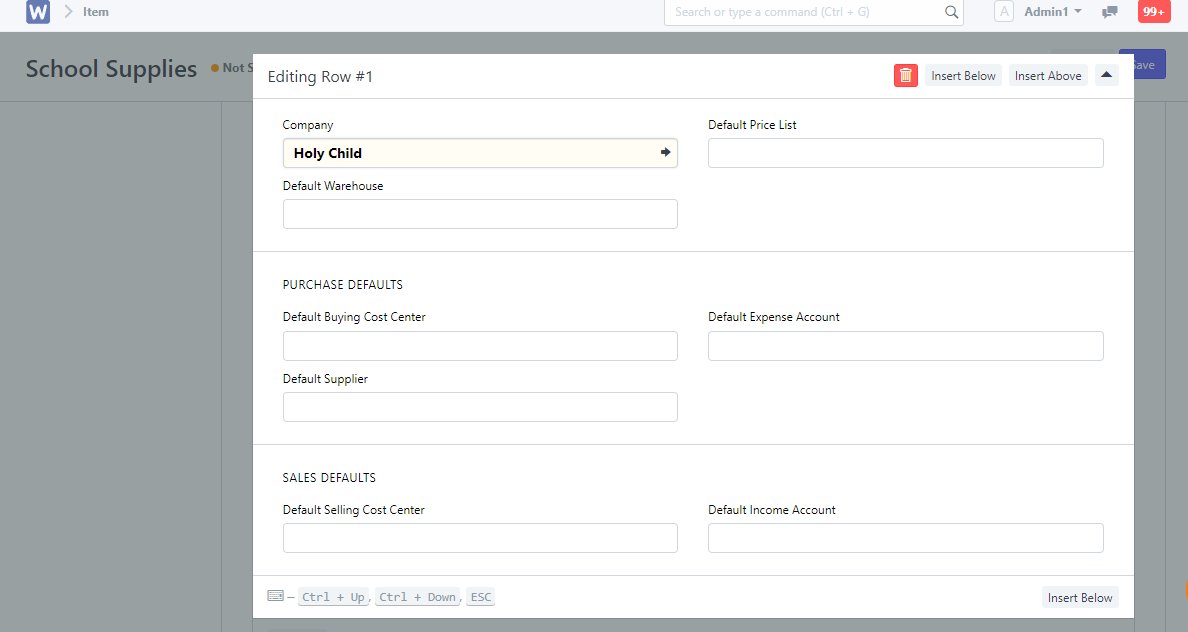

2. Item Account Default

In this section, you can define Company-wide transaction-related defaults for this Item.

- Default Expense Account: It is the account in which cost of the Item will be debited.

- Default Income Account: It is the account in which income from selling the Item will be credited.

- Default Cost Center: It is used for tracking expense for this Item.

Default Account it is the general account of the item in which cost of the item will be debited